Easy Loans Ontario: Easy Access to Financial Resources

Easy Loans Ontario: Easy Access to Financial Resources

Blog Article

Navigate Your Financial Journey With Trusted Lending Solutions Designed for Your Success

In the vast landscape of financial administration, the path to achieving your objectives can often seem challenging and facility. With the right guidance and assistance, navigating your financial trip can become a more effective and workable undertaking. Dependable car loan services customized to satisfy your certain needs can play an essential duty in this process, using a structured technique to securing the needed funds for your ambitions. By recognizing the details of different finance alternatives, making notified decisions throughout the application procedure, and successfully handling repayments, individuals can leverage financings as tactical devices for reaching their economic turning points. But how exactly can these services be maximized to make certain lasting monetary success?

Understanding Your Financial Demands

Understanding your economic needs is critical for making informed choices and accomplishing monetary security. By taking the time to examine your monetary situation, you can determine your long-term and temporary objectives, develop a budget plan, and establish a plan to reach economic success.

In addition, recognizing your monetary requirements involves acknowledging the distinction in between important expenditures and optional investing. Prioritizing your requirements over wants can help you handle your finances better and prevent unnecessary financial debt. In addition, take into consideration variables such as reserve, retired life planning, insurance protection, and future monetary goals when examining your monetary demands.

Exploring Car Loan Choices

When considering your economic demands, it is important to explore numerous funding alternatives offered to figure out one of the most ideal service for your certain scenarios. Comprehending the different types of finances can assist you make notified decisions that align with your financial objectives.

One typical type is a personal funding, which is unprotected and can be used for different functions such as financial debt loan consolidation, home enhancements, or unforeseen expenses. Individual lendings commonly have actually taken care of rate of interest and monthly payments, making it simpler to budget plan.

Another option is a secured car loan, where you offer collateral such as a cars and truck or property. Protected financings frequently feature reduced interest rates due to the decreased danger for the lender.

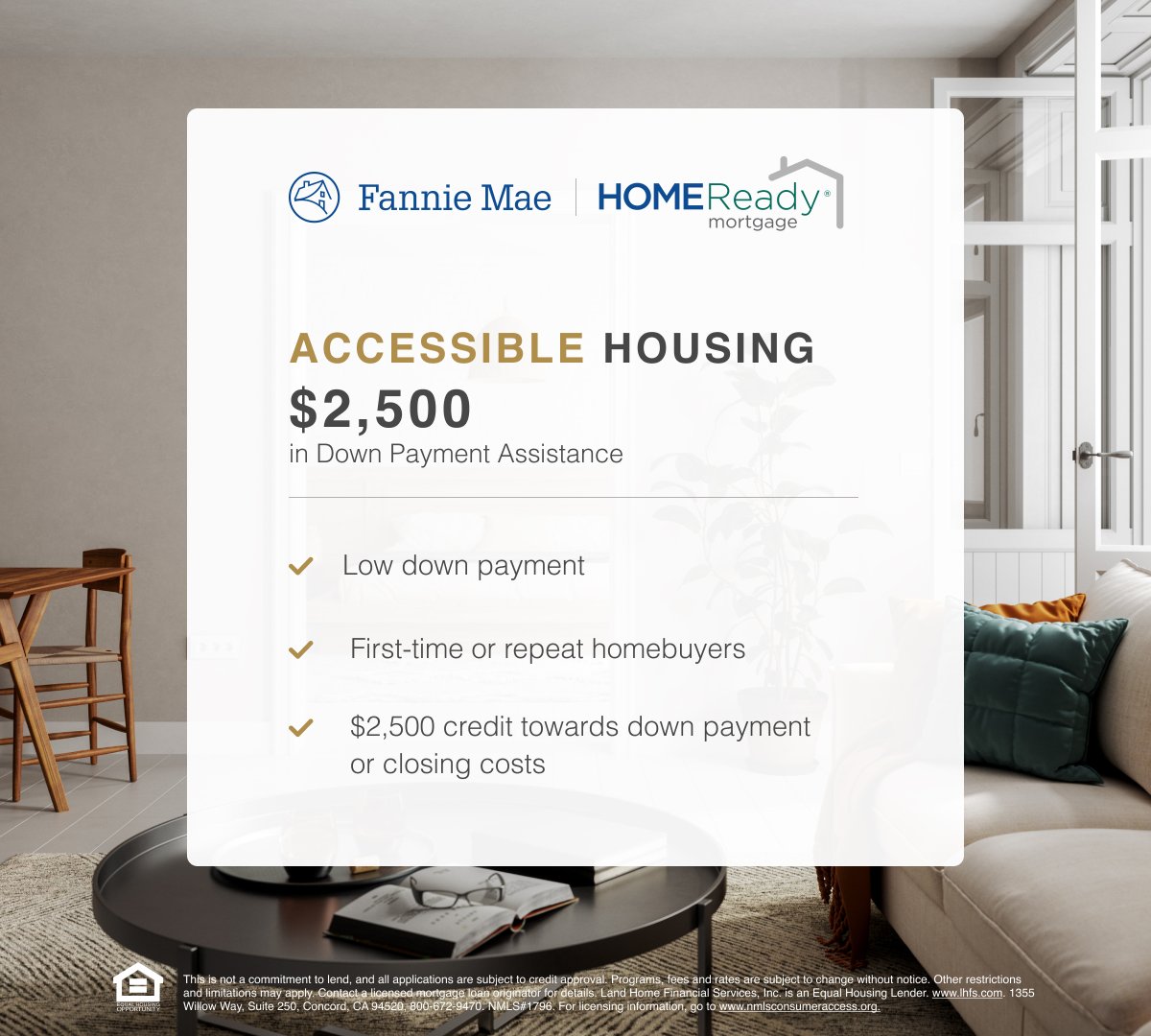

For those seeking to purchase a home, a home loan is a prominent choice. Home mortgages can differ in terms, rate of interest, and down payment requirements, so it's critical to discover different loan providers to discover the best fit for your situation.

Looking For the Right Car Loan

Browsing the process of applying for a financing requires a detailed assessment of your economic requirements and diligent study into the offered options. Begin by assessing the function of the funding-- whether it is for a significant purchase, debt combination, emergency situations, or other demands.

Once you've identified your monetary requirements, it's time to explore the car loan items used by various lending institutions. Compare rates of interest, repayment terms, charges, and qualification standards to locate the financing that finest matches your requirements. Furthermore, think about factors such as the lender's credibility, client service top quality, and online devices for managing your car loan.

When requesting a lending, guarantee that you supply accurate and complete info to quicken the approval process. Be prepared to submit documentation such as proof of revenue, recognition, and monetary statements as needed. By very carefully selecting the appropriate loan and finishing the application carefully, you can establish on your own up for economic success.

Handling Financing Payments

Reliable monitoring of lending payments is essential for keeping monetary stability and meeting your responsibilities sensibly. By clearly determining how much you can designate in the direction of lending repayments each month, you can make sure timely repayments and stay clear of any monetary pressure.

If you run into difficulties in making repayments, interact immediately with your lender. Many financial institutions use alternatives such as car loan deferment, restructuring, or forbearance to help consumers encountering financial challenges. Overlooking payment concerns can result in extra costs, a negative effect on your credit history rating, and potential legal effects. Seeking assistance and discovering readily available options can help you navigate via momentary economic problems and protect against long-term repercussions. By actively managing your lending settlements, you can maintain monetary wellness and job in the direction of attaining your lasting monetary goals.

Leveraging Fundings for Financial Success

Leveraging fundings strategically can be an effective device in accomplishing economic success and reaching your lasting goals. When utilized sensibly, loans can supply the necessary funding to purchase opportunities that might produce high returns, such as beginning an organization, pursuing higher education and learning, or spending in property. loan ontario. By leveraging car loans, people can increase their wealth-building procedure, as long as they have a clear prepare for settlement and a comprehensive understanding of the risks entailed

One trick facet of leveraging finances for economic success is to carefully examine the conditions of the loan. Understanding the passion prices, payment routine, and any kind of affiliated charges is critical navigate to this website to make certain that the car loan straightens with your economic objectives. Additionally, it's necessary to borrow only what you require and can reasonably afford to settle to prevent coming under a debt trap.

Conclusion

By comprehending the complexities of various loan options, making informed decisions during the application procedure, read more and effectively managing settlements, individuals can utilize finances as calculated devices for reaching their economic landmarks. easy loans ontario. By actively handling your lending repayments, you can keep monetary health and job in the direction of accomplishing your long-term monetary objectives

One trick element of leveraging finances for monetary success is to carefully analyze the terms and problems of the car loan.In final thought, recognizing your financial requirements, discovering car loan choices, applying for the ideal finance, managing car loan settlements, and leveraging loans for monetary success are important steps in navigating your financial journey. It is crucial to meticulously think about all facets of car loans and monetary choices to make certain web lasting economic stability and success.

Report this page